Understanding the Medicare levy and Medicare levy surcharge

What is Medicare levy?

The Medicare levy is a small tax most Australians pay to help fund our public health system. It’s 2% of your taxable income and is automatically included in your total tax payable at tax time.

Who pays the Medicare levy?

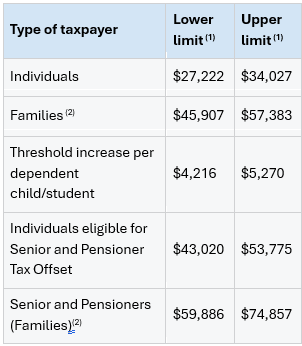

Most Australian residents will pay the 2% Medicare Levy, once their income reaches the Medicare threshold as in the chart below. For most taxpayers once they earn $27,222 they will start paying some form of Medicare. However, in certain cases, you might get a reduction or even an exemption from the Medicare levy. For instance, if you meet specific conditions such as being a low-income earner, foreign resident or having a medical exemption, you may qualify for a reduced rate or full exemption.

(1) A phase-in of 10 cents per $1 applies above the lower limit.

(2) Applies to families where there are no children and/or students.

What is Medicare levy surcharge?

The Medicare Levy Surcharge is an added charge that medium – high income earners pay in addition to the Medicare Levy. It is designed to encourage more Australians to take out private hospital insurance.

Who pays the Medicare levy surcharge?

The Medicare levy surcharge only kicks in if you earn above certain income levels:

- You’re single and earn over $101,000 a year, OR

- You’re a family with a combined income above $202,000

The good news is you can avoid the surcharge if you and your family (or dependants as defined by the ATO) have private hospital cover. The key here is Hospital cover, just keep in mind that extras-only policies don’t count, so things like dental or physio cover on their own won’t help you avoid the surcharge.

Please note that income for Medicare Levy Surcharge purposes is the sum of your taxable income, reportable fringe benefits, net investment losses and reportable super contributions.

How is the Medicare levy surcharge calculated?

The surcharge is calculated as a simple percentage of your annual income. In general, the more you earn, the more surcharge you pay.

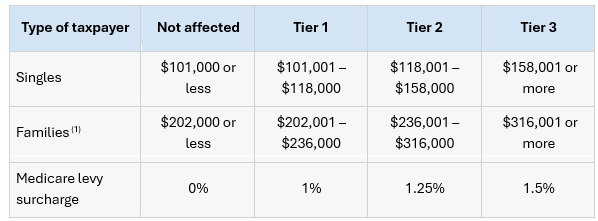

Medicare Levy Surcharge income tiers for 2025–26 financial year are:

(1) Family income level threshold is increased by $1,500 for each dependent child after the first.

More GTP Articles