Hobby vs Business

Am I in business?

This might seem like a strange question, but for some taxpayers it is very important to consider as income generated from a hobby is generally not taxable income and all expenses incurred are not deductible as a result.

We’ve had lots of questions about this in the past from people who may be running a stall at local markets selling hand made goods, or creating digital content and receiving remuneration and goods as a part of this.

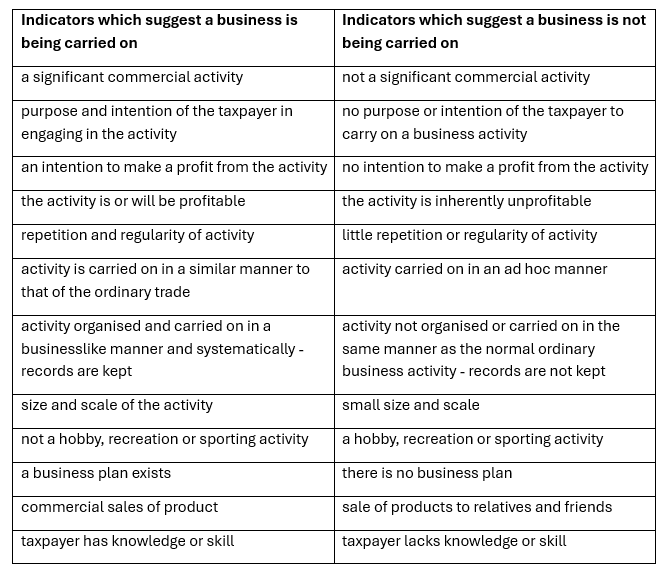

Sometimes it can be hard to tell if this income is derived in pursuing a hobby or operating a business, but there are some important determinations set out by the ATO to consider.

The entire scope must be considered in relation to the below, not just one point, for example if an activity is completed ad hoc with no business plan, but the activity is completed with profit making intentions this is likely to be deemed as a business.

Essentially, the intention, regularity and purpose of the activity can help to identify whether it is a hobby or a business, the most important thing to consider is what is the purpose of the activity. If you are just completing an activity solely for enjoyment and recuperating input costs by selling to family and friends, this could just be a hobby. But this can get very difficult to determine when getting into the nitty-gritty details, so if you are needing any help in determining whether your activity is a hobby or a business, please contact our office to discuss this further.

More GTP Articles