By Jarrod Kemp

•

January 7, 2026

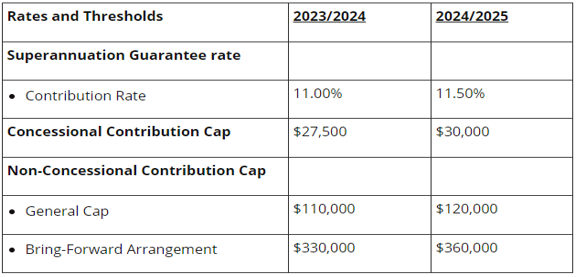

The True Cost of Hiring Your First Employee in Australia Hiring your first employee is a huge milestone for any business. It often signals growth, increased demand, and the shift from “doing everything yourself” to building a team. But while many business owners budget for wages, the true cost of employing someone is far higher than just their salary. If you’re planning to hire staff members, here’s what you really need to factor into your budget. Base Wage or Salary (The Obvious Cost) This is the figure most business owners focus on first. Whether you’re paying: An hourly wage A casual rate Or a full-time salary You must ensure it meets: Fair Work minimum award rates Any applicable enterprise agreements Penalty rates, overtime, and allowances where required Superannuation (Currently 12%) On top of wages, you must pay Superannuation Guarantee (SG) for eligible employees. This is currently 12% of ordinary time earnings. Example: If your employee earns $70,000 per year, super cost = $8,400 per year (at 12%) This cost is in addition to their salary, not part of it (unless you’ve structured a total remuneration package). Workers’ Compensation Insurance Workers’ comp insurance is compulsory in every state and territory. The cost varies depending on: Your industry Your claims history The risk classification of your work Total payroll For low-risk office environments it may be modest, but for trades, transport, or physical industries it can be a significant annual expense. Payroll Tax (For Growing Businesses) You won’t pay payroll tax immediately, but once your total wages exceed your state or territory threshold, payroll tax applies. This often catches growing businesses by surprise, especially when they: Hire their second or third employee Scale quickly Employ across multiple states While it may not apply to your very first hire, it should absolutely be part of your forward planning. Leave Entitlements If you employ someone full-time or part-time, you’re responsible for: Annual leave Personal leave Public holidays Long service leave These entitlements build up as a liability on your balance sheet, even though you’re not paying them immediately. This affects your real profit and cash flow. Recruitment & Onboarding Costs Hiring isn’t free. Many businesses underestimate the upfront costs, such as: Job ads on employment platforms or recruitment agencies Time spent reviewing applications and interviewing Training and supervision during the onboarding period During the early weeks or months, your new employee may not yet be fully productive — but you’re still paying full costs. Systems, Software & Equipment Your new employee may require: A laptop, phone, or tablet Software subscriptions Uniforms or protective equipment Desk space, tools, or vehicles These costs can easily run into thousands of dollars upfront. Increased Accounting & Compliance Costs Once you employ staff, your compliance responsibilities grow: Payroll processing Single Touch Payroll (STP) reporting Superannuation processing Workers’ comp reporting Leave tracking and entitlements Many businesses require upgraded accounting support or payroll services once they take on staff. The “Real Cost” Multiplier A common rule of thumb is that the true cost of an employee is 1.25x to 1.4x their base salary once you factor in super, insurance, leave, payroll systems, and overheads. For example: Base Salary Estimated True Cost $60,000 $75,000–$84,000 $80,000 $100,000–$112,000 This is why hiring without proper cash-flow forecasting can put enormous strain on small businesses. Can Your Business Actually Afford the Hire? Before hiring, it’s worth asking: Will this employee increase revenue, or only reduce workload? How many extra sales or billable hours are needed each month to break even? Do you have 3–6 months of wage costs buffered in cash? Hiring too early can be just as risky as hiring too late. Hiring your first employee is exciting, but it’s also one of the biggest financial commitments your business will ever make. Looking beyond wages to understand the full financial impact can help you: Avoid cash-flow pressure Stay compliant Grow your business sustainably If you’re considering your first hire, or adding extra staff, and want help modelling the true cost, forecasting cash flow, or setting up payroll properly, please feel free to contact our office to discuss this further.